It’s both a blessing and a curse that we can’t see into the future. Americans wouldn’t have enjoyed the 1920s nearly as much had they known what awaited them in the early ’30s. But, then again, they likely could’ve avoided the pain if they’d had the sort of 20/20 vision only hindsight affords us. As we saw in the previous chapter, the Industrial Revolution kicked into high gear in the 1920s as homes and factories plugged into the expanding electrical grid. New cars and trucks traversed a growing network of roads and cities while tractors cultivated enough land to feed the planet. America was the world’s leading workshop, its consumers providing a seemingly insatiable appetite for new products and goods.

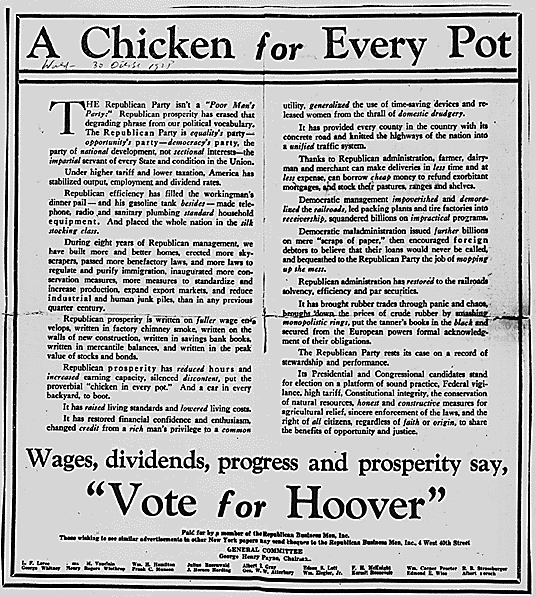

No one blinked an eye when Republican Herbert Hoover won the 1928 presidential election promising “a chicken for every pot and car in every garage.” Aside from being a fairly unoriginal variation on William McKinley’s 1900 “full dinner pail” motto, Hoover’s perpetual prosperity ended up being the most famously broken promise in political history. What went wrong was the subject of debate then and has been ever since. It’s an important question since the country will continue to experience economic gyrations and try to address them for as long as American civilization lasts. Your odds of avoiding such disruptions over the course of a long lifetime are virtually zero. But the issues are too complex to lend themselves to consensus solutions or diagnoses and thinking people disagree widely.

Today’s liberals and conservatives interpret the 1930s Great Depression about as you’d expect them to: liberals arguing the government didn’t do enough and that what it tried helped and conservatives arguing that government did too much, exacerbating or even causing problems. In case you hadn’t guessed already, you’re not about to read a simple analysis that finally gets to the bottom of it, settles the dispute once and for all, and provides a simple prescription to ensure we’ll never suffer economic pain again. If your author had such answers, he would solve the world’s current problems, win Nobel Prizes, and charitably agree to be underpaid for a billion dollars per year. Economics plays out amidst many moving parts acting on unpredictable humans and events, so it can’t be studied in a controlled laboratory or reduced to simple graphs. It’s understandable that leaders at the time struggled and the truth is we wouldn’t agree on what to do about the Depression even with 20/20 hindsight. Politicians and talking heads feed us over-simplified slogans and ideas while even the real experts on the “dismal science” (economics) struggle to wrap their heads around what’s going on.

If there is one redeeming feature about this chapter in economic history, it’s that many competing explanations concerning the causes of the Great Depression aren’t mutually exclusive. Since they don’t contradict each other, we can take a bit of an all-of-the-above, perfect storm approach and look at an unfortunate combination of causes for the United States’ worst economic meltdown. In the next chapter, we’ll examine how Hoover’s successor, Democrat Franklin Roosevelt, coped with the downturn and how the U.S. finally picked itself up off the mat in the late 1930s. Roosevelt’s New Deal and the controversy surrounding it set the basic parameters of today’s left-to-right political spectrum or, more narrowly, the political-economic spectrum. Here we’ll look at how and why things spiraled downward from 1929 to ’33.

Looming Recession

The market for durable goods that drove the industrial economy in the 1920s was already slowing by the time President Hoover took office. Durables are appliances, radios, cars, etc., as opposed to perishables like food and clothing. From the seller’s perspective, durables were too durable insofar as they didn’t break down fast enough, and those that could afford them already had them. Manufacturers hadn’t yet mastered the art of planned obsolescence the way modern appliance companies or software firms have (or Apple with iPhones®). For working classes, wages improved in the 1920s but hadn’t risen as fast as productivity and investment, so workers weren’t providing the necessary demand to meet output. That decline in aggregate demand caused a recession that was brewing prior to the Stock Market Crash of October 1929. Income inequality, in other words, meant that the working poor couldn’t buy enough goods to keep rich people in business, confirming Henry Ford’s counter-intuitive idea that low wages aren’t necessarily good for management, especially from a nationwide perspective.

Another problem was that for those that could afford goods, the 1920s boom was credit-driven, with many appliances and cars (60%) bought on installment plans. Buy Now Pay Later, a concept virtually unknown in many parts of the world to this day, was an all-too-familiar phrase in America by the 1920s. When the economy dipped into a recession in the late ’20s, many consumers stopped buying new items, including even fewer groceries and clothes, to preserve income for installment plans on durables they already had. Strict loan terms stipulated that they’d lose all the equity they’d already paid in if they missed just a single payment. Even after the Great Depression started, families that stayed employed continued to pay off debts on everything but their homes, fueling the consumer credit industry but contributing to housing foreclosures.

Saturation of the durable goods market and high consumer debt weren’t the only problems. There was a real estate bubble caused mainly by the Florida Land Boom. New home construction outpaced population growth by 25% in the 1920s and the portion of renters buying homes didn’t keep up with supply. Immigration, meanwhile, was at a standstill due to the Immigration Act of 1924. It turns out, racism is expensive, as xenophobia was bad for the housing industry. And, just as durable goods installment plans were unforgiving, homeowners faced higher payments on shorter loans than the 15- and 30-year mortgages common today. Unsurprisingly, construction was sluggish by late 1928.

Then drought started to plague agriculture in the late 1920s. Many farmers on the Southern Plains were over-extended after investing in new land and equipment during the wheat boom that followed WWI, when European farming hadn’t yet recovered from the war. They were already in debt when the Dust Bowl hit, starting in 1930-31. Like agriculture, neither mining nor textiles thrived as much as other industries in the 1920s. But coal contributed to electrical power the same way it had steam in the 19th century, except now as fuel for boilers that converted steam power to electricity (nuclear plants likewise convert atomic energy to steam to electricity).

The success of assembly line-driven industries offset the declining farming sector for a while, but capitalism is cyclical. The country’s long post-war boom was bound to lose momentum and bust at some point. Moreover, the downturn was international in scope, especially with Germany unable to get out from under the huge debt the Allies heaped upon it after WWI. What had been the emerging industrial power of central Europe rallied briefly in the mid-1920s but was struggling by 1929. Also doing poorly were new countries carved from the former Austro-Hungarian Empire at the Versailles Conference, like Poland and Czechoslovakia.

Stock Market Shenanigans

Closer to home, financial markets were out of whack. The stock market was in a speculative bubble as opposed to a purely growth-driven upswing. Stock shares are tiny slices of companies anyone can buy if a company is public rather than privately owned. Steve Jobs, for instance, didn’t privately own Apple; he ran a company owned by millions of other shareholders. The stock market is important because many Americans save for retirement through 401(k)’s, IRA’s, or pension funds invested in stock and bonds. Even those that don’t can’t escape the impact of market fluctuations, as demonstrated during the Great Depression.

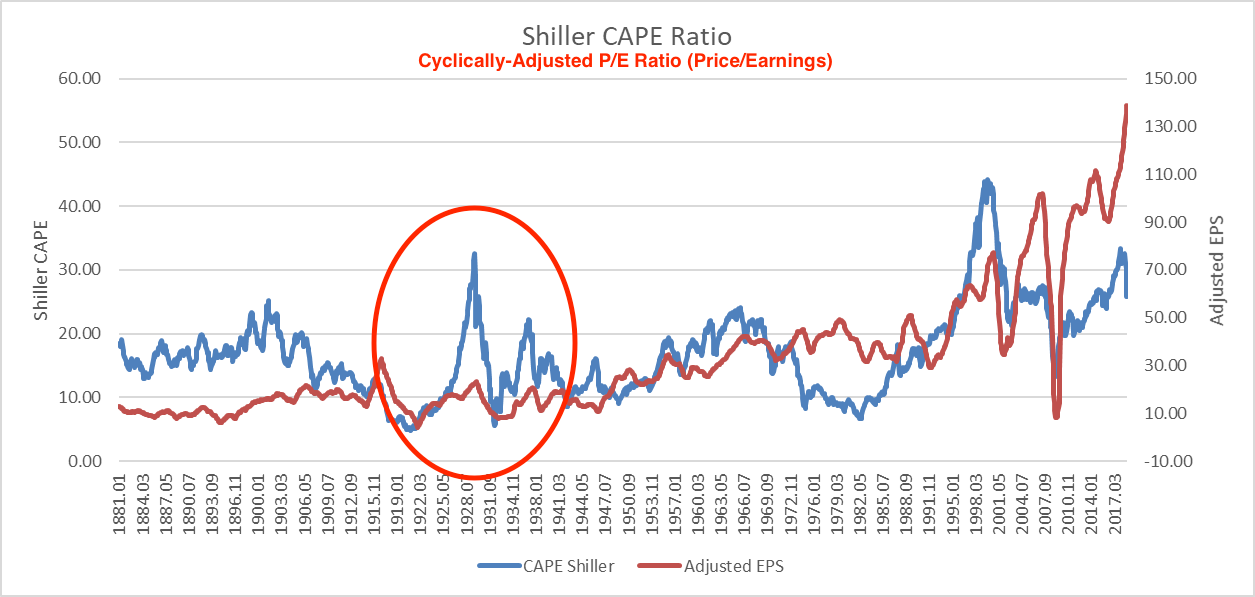

In 1929, stock share prices were running higher than their historical average in relation to how much companies were actually earning (price-earnings, or P/E ratios, above). Corruption increased the market’s instability. Small groups of wealthy men “painted the tape,” driving up prices artificially by buying themselves, only to sell at high profits after other “suckers” bought into the rally. Pool operators could make money virtually at will in pump and dumps, to use the modern phrase for manipulating small-cap stocks by hyping them and selling before the price drops back down. In the 2010s, the SEC tried, at least, to regulate cryptocurrency and fake blockchain-related companies that services like Crypto Calls brazenly ran up prices on for a fee. The reverse is shorting stock and driving the price down, then buying before it goes back up, as Henry Ford did in the previous chapter to buy out minority investors. If you’ve seen Wall Street (1987) or The Wolf of Wall Street (2013), that’s what the fictional Gordon Gekko and non-fictional Jordan Belfort were doing in the 1980s and ’90s. It’s what some brokers have always done, in tandem with journalists and stock analysts who influence public opinion about companies.

Waldorf-Astoria Hotel Employees Operate Tickers and Stock Exchange Boards, 1918, War Department-National Archives

No organized crime syndicates or counterfeiters in history have ever come up with a racket as profitable as manipulating stock prices. Al Capone must have been back in Chicago in the 1920s wondering why he was working so hard making a dishonest living bootlegging alcohol when the easy money could be made legally on Wall Street. Capone had to manage a vast distribution network, all the while keeping competition and law at bay with a small army of Tommy Gun-toting thugs. Pool operators, conversely, just planted a few well-placed rumors and then sat back running the ticker through their fingers while puffing cigars and chuckling amongst themselves. Jesse Livermore was the most notorious “player,” along with General Motors founder William Durant, who’d realized by then that moving stocks was easier than challenging Ford making cars. People knew what was going on and that the players paid off newspapers to print news about companies, but small investors still hoped to ride the prices up themselves and not be the ones left holding the “chop stock” in the sell-off. The impact of pool operators on small investors wasn’t so much negative as random. It was like a game of musical chairs; as long as you had a chair each time the music stopped (had already sold your shares), it didn’t matter that it was just a game.

By the late 1920s, the entire market had become a game of musical chairs that wasn’t controlled by any one pool. In fact, many operators ended up being the biggest victims. Durant died penniless. Speculators hoped other investors would pay more as prices rose regardless of company earnings, while others just lost their heads in what modern economists call a fit of “irrational exuberance” (aka greed). Here’s a lesson you might as well learn earlier in life than later: bubbles burst. They are as unlikely to not burst as you are likely to blow gum into an infinitely expanding bubble that never pops and covers your face in pink goo.

By the late 1920s, the entire market had become a game of musical chairs that wasn’t controlled by any one pool. In fact, many operators ended up being the biggest victims. Durant died penniless. Speculators hoped other investors would pay more as prices rose regardless of company earnings, while others just lost their heads in what modern economists call a fit of “irrational exuberance” (aka greed). Here’s a lesson you might as well learn earlier in life than later: bubbles burst. They are as unlikely to not burst as you are likely to blow gum into an infinitely expanding bubble that never pops and covers your face in pink goo.

1920s investors fell for the classic it’s different this time mantra — the so-called “five most dangerous words on Wall Street” — because the economy was powered by electricity for the first time, so boosts in productivity and consumer spending seemed potentially infinite. Respected Yale economist Irving Fisher declared that “Stock prices have reached what looks like a permanently high plateau.” RCA couldn’t make radios fast enough to keep up with demand. The Internet caused similar exuberance in the 1990s, leading to similar but less catastrophic results in 2000. These theories of growth aren’t entirely wrong in the long-term. Overall productivity and growth have continued upward, so far, since the Market Revolution started in the late 18th century. It doesn’t follow, though, that stock valuations (e.g., P/E ratios) can rise infinitely in the near-term with no regard to corporations’ actual profitability. In those cases, a correction, aka a bursting bubble, is inevitable. A similar correction was bound to happen in the early 21st-century real estate boom. When asked if we were in a speculative bubble then, real estate agents were fond of saying “God isn’t making more land.” Perhaps not, but that didn’t mean that the cost of homes in relation to salaries and cost of living could rise infinitely, and that bubble burst in 2008 (except in Austin, where there was only a small hiccup).

J.P. Morgan photographed by Edward Steichen in 1903; the photo is known for the light reflected off the armrest being interpreted by viewers as a knife.

To his credit, President Herbert Hoover recognized the difference between growth and speculation and implored big bankers like J.P. Morgan to stem the enthusiasm. Even earlier, as Secretary of Commerce under President Warren Harding, Hoover warned that stock speculation was getting out of hand. He asked writers to editorialize on the dangers of the Wall Street bubble. Fearing that such talk would itself set off a panic, the establishment collectively told Hoover to shut his pie hole. Hoover didn’t get much help from the Federal Reserve or Treasury, either. The Fed recognized the problem but did nothing, even as the president-elect encouraged them to raise interest rates (then at 6%) on investment banks to curb “crazy and dangerous” gambling. Morgan encouraged Hoover to take a cue from his predecessors, Harding and Calvin Coolidge, and mind his own business. Hoover then appealed to New York’s Governor Franklin Roosevelt to do something but that, too, fell on deaf ears. This might catch some readers’ attention. As we’ll see in the next chapter, it was none other than Roosevelt who capitalized on the ensuing mess by riding it all the way to 1600 Pennsylvania Avenue to replace Hoover in the White House.

President Hoover’s Treasury Secretary, Andrew Mellon, contributed to the boom by deregulating Wall Street while serving under Harding and Coolidge. Mellon, who made his own fortune in steel and banking, also cut taxes from their high WWI-era levels, and had moderate success reducing the national debt early in his tenure. But Mellon and the Federal Trade Commission allowed high rates of on margin investing, meaning that speculators could borrow high ratios of cash from brokers to invest, up to 90% of the stocks’ face value. Margin investing worked fine as the market continued upward and stock price appreciation exceeded the marginal loan rates. But when stocks fell brokers called in their loans and investors didn’t have the money. Once the price of a stock dropped 10%, brokers sold the stock and called in their loans from investors. Since margin investing was so widespread, this triggered a cascading effect once the market dropped.

Still, brokers encouraged customers to borrow so they could invest more and the brokers got their commission fees. These customers weren’t just rich old white guys that looked like Morgan or Rich Uncle Pennybags from the Monopoly™ game. For the first time in the market’s history, investors included middle-class Americans. The ringleader was Charles Mitchell of National City Bank (now Citi), whose bank became the largest issuer of securities in the world and who pioneered selling stock to small investors, pioneering what are now known as mutual funds. Citi also contributed to the financial crisis of 2008-09 but helped offset these sins by helping fund the Transatlantic Telegraph Cable in 1866 and the Panama Canal in 1904.

By 1929, more money was lent to on-margin investors than the entire amount of cash circulating in the country. Investing had become a craze, with people attending parlors just to sit and watch replicas of the “Big Board,” or New York Stock Exchange, go up and down based on readings from an Edison ticker (such establishments were popular recently in China). Evangeline Adams, an astrologer supposedly descended from John Quincy Adams, offered investing tips in a regular column, usually Buy More. Cruise ships in the Atlantic had minute-to-minute updates radioed in. It was almost like today, except that now people can follow prices on an up-to-the-millisecond basis with the right hardware. They installed revamped fiber-optic cable between New York and Chicago in 2012. “Citizen investors” dated to World War I, when the government piqued middle-class interest in securities by selling low-denomination Liberty Bonds. After the war, interest carried over to the stock market as companies like AT&T broke their shares down into lower unit prices, enabling small investors. Additionally, companies began offering stock purchase plans, much to the dismay of labor unions who saw such plans as a ploy to co-opt workers, but offering the prospect of riches to employees if the company grew (e.g., software writers at Microsoft in the 1980s are now multi-millionaires).

October Crash

Hollywood mogul and financier Joseph Kennedy, JFK’s father, purportedly said that, when his shoeshine boy gave him stock tips, he knew it was time to get out. He did just that, selling stocks and even selling short in time to profit from the downturn. Other big investors started to wonder if the rally had run out of steam by mid-summer 1929, including Jesse Livermore, who pocketed over $100 million in the coming collapse. Unfortunately, selling and short selling (betting against the market) are as contagious as buying and too much “smart money” panicked at the same time, hoping to jump the ship before it sank.

At first, “organized support” led by NYSE VP Richard Whitney and big bank CEO’s bought blue-chip stocks, propping up prices as they had in the 1907 panic. Mitchell, Durant, and the Morgan and Rockefeller families chipped in on “Black Thursday,” October 24th, bidding stocks up enough to correct the collapse and even cause a late-afternoon rally. Yale’s Fisher said the market was merely “shaking out the lunatic fringe.” By Friday, things looked good and bankers tried to pressure President Hoover into issuing a statement about how stocks were cheap. He refused, but said, “The fundamental business of this country, that is the production and distribution of commodities, is on a sound and prosperous basis.” But unlike 1907 the bankers’ buying splurge wasn’t enough, as too many people decided over the weekend that it was time to preserve what wealth they could and sell out.

On Monday and “Black Tuesday” the market continued to fall, closing down 36% from where it had been the previous mid-week. Simply put, there were far more sellers than buyers at given prices. Some big bankers that were propping up the market the previous Thursday started liquidating their own portfolios, even as they increased loans to stave off a run on cash. The Federal Reserve regional banks (Chapter 5) madly bought up bonds to re-inject cash into the system. Exhausted brokers across the country spent days trying to sift through the high volume of trades. Some trades never executed while other customers had their entire portfolios sold multiple times. Chicago police prepared for rioting as gangsters absorbed big losses in their margin accounts. The on-margin investing that fueled the boom now triggered the aforementioned cascading effect as brokers sold stock when it dropped 10% and called in their loans, causing even bigger sell-offs. Leveraged investing by big trusts magnified the problem, causing consumers who’d invested in trusts rather than buying individual companies to lose everything. Many investment trusts had invested in each other as well and used their customers’ money to buy back declining stock in their own companies. The $30 billion that evaporated the first week was 10x more than the entire federal budget and more than all of what the U.S. spent on WWI.

Still, it wasn’t immediately apparent that the country was in for a long and severe depression. The New York Times predicted the Crash would cause a downturn in consumer spending on luxury items, but not much else, underestimating its impact on middle and working-class America. Similar downturns had occurred before and most people thought this one would correct itself soon enough. Most companies were still sound and automakers marked the downturn by cutting prices, with Ford’s roadster dropping from $450 to $435. Now, at least, stocks would sell based on sound earnings fundamentals rather than speculation. Barron’s pointed out that stocks could now sell “ex-hopes and romance.” Smart money that was out of the market for the crash jumped back in to take advantage of seeming bargains. At the end of 1929, the Times announced its annual biggest story of the year: Richard Byrd’s solo flight over Antarctica. Byrd, by the way, had regular stock quotes radioed to his Little America station at the South Pole.

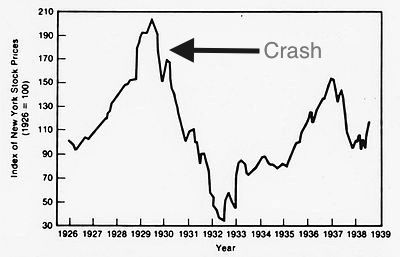

The market rebounded some by early 1930, and many commentators thought the hiccup would be no worse than the previous downturn in 1921. When some bankers and theologians met with President Hoover in June 1930 to discuss the recession, he proudly told them, “Gentleman, you’ve come 60 days too late. The depression is over.” But the worst was yet to come, and almost all of the big downturn erroneously associated with the “Crash of 1929” actually occurred slowly and painfully from 1930-32. By 1932, the Dow Jones Industrial Average had plummeted 89% overall from its 1929 high, while the initial decline of October 1929 was just 25%. That’s no more than a sudden downturn in October 1987 that didn’t cause a recession and similar to later market corrections in 2000, 2008, and 2020. Economist J.K. Galbraith later wrote of the seeming recovery and temporary market rebound that, “Nothing could have been more ingeniously designed to maximize the suffering, and also to ensure that as few as possible escaped the common misfortune.” Galbraith most famously quipped that “the function of economic forecasting is to make astrology look respectable.”

The market rebounded some by early 1930, and many commentators thought the hiccup would be no worse than the previous downturn in 1921. When some bankers and theologians met with President Hoover in June 1930 to discuss the recession, he proudly told them, “Gentleman, you’ve come 60 days too late. The depression is over.” But the worst was yet to come, and almost all of the big downturn erroneously associated with the “Crash of 1929” actually occurred slowly and painfully from 1930-32. By 1932, the Dow Jones Industrial Average had plummeted 89% overall from its 1929 high, while the initial decline of October 1929 was just 25%. That’s no more than a sudden downturn in October 1987 that didn’t cause a recession and similar to later market corrections in 2000, 2008, and 2020. Economist J.K. Galbraith later wrote of the seeming recovery and temporary market rebound that, “Nothing could have been more ingeniously designed to maximize the suffering, and also to ensure that as few as possible escaped the common misfortune.” Galbraith most famously quipped that “the function of economic forecasting is to make astrology look respectable.”

Banking & Consumer Spending

The Wall Street Crash didn’t cause as much disruption as it would today, when regular Americans own ~ 66% of stock on the NYSE and Nasdaq markets. The 1929 crash didn’t cause the Great Depression outright, with only 10% of Americans invested in the market, but it lowered consumer spending, caused panic that worsened an ongoing recession, reduced corporations’ assets and hurt their future prospects, and contributed to a banking crisis. The crash, in short, complicated and amplified an ongoing recession while undermining banks that had invested, directly and indirectly, in the stock market. Banks were the critical link between the stock market and general public.

But, among that 10%, the crash reduced millions of investors to paupers within a matter of months, both rich and middle-class. Remember Clarence Birdseye from the previous chapter? He sold his frozen packaged foods business and put all his money in stocks just before the crash. British politician Winston Churchill had most of his money in the market. The downturn reduced consumer spending, even as a normal recession was already in the works prior to Black Tuesday. The drop-off in consumer spending/confidence lowered corporate earning power, as the market dropped through fits and starts until 1932. In addition to earnings, corporations rely on investments for money (shareholder equity), so the downturn meant they wouldn’t be able to generate as much cash in the future. Corporations invest in other corporations, too, so the crash further depleted their coffers. As their asset values plummeted, corporations couldn’t borrow money from banks as easily, either, since borrowing rates rose. Market sell-offs are especially hard on capital-dependent businesses like banks. Most investors were shy about investing after the October crash, despite cheap prices, because of continued uncertainty. You could think of that as another drop-off in consumer spending.

Moreover, banks didn’t want to lend to businesses or each other in this uncertain environment, meaning that new growth-promoting projects stalled. Consequently, the normal business cycle didn’t bottom out and start a fresh upturn. Banks that lent money to consumers for on-margin investing lost much of what they’d loaned, and they lost some of their loans to businesses once the downturn kicked in. In turn, they loaned less to other corporations, individuals and small businesses. Banks had invested their own depositors’ money in the stock market, too, with that portion raising from 5% to 12% in the late 1920s. The spread between what banks pay customers in interest and what they earn with customers’ money through investments or higher-interest long-term loans is how they make a profit. Traditionally, small, local banks and savings & loans earn their money on the spread between long-term loans and the interest they pay customers on savings accounts; whereas investment banks, as their name implies, took more risk. In the early 1930s, anxious customers rushed to pull out their savings, but, as in any era, with most of their depositors’ money invested or loaned out, banks didn’t have cash in their vaults corresponding to all their savings and checking accounts. Before the FDIC, the government didn’t insure customers’ accounts, so they lost all or most of their money if the bank went under. If too many customers tried to withdraw at the same time in a “bank run” it triggered a self-fulfilling prophecy of failure.

Moreover, banks didn’t want to lend to businesses or each other in this uncertain environment, meaning that new growth-promoting projects stalled. Consequently, the normal business cycle didn’t bottom out and start a fresh upturn. Banks that lent money to consumers for on-margin investing lost much of what they’d loaned, and they lost some of their loans to businesses once the downturn kicked in. In turn, they loaned less to other corporations, individuals and small businesses. Banks had invested their own depositors’ money in the stock market, too, with that portion raising from 5% to 12% in the late 1920s. The spread between what banks pay customers in interest and what they earn with customers’ money through investments or higher-interest long-term loans is how they make a profit. Traditionally, small, local banks and savings & loans earn their money on the spread between long-term loans and the interest they pay customers on savings accounts; whereas investment banks, as their name implies, took more risk. In the early 1930s, anxious customers rushed to pull out their savings, but, as in any era, with most of their depositors’ money invested or loaned out, banks didn’t have cash in their vaults corresponding to all their savings and checking accounts. Before the FDIC, the government didn’t insure customers’ accounts, so they lost all or most of their money if the bank went under. If too many customers tried to withdraw at the same time in a “bank run” it triggered a self-fulfilling prophecy of failure.

Monetary Policy

Congress set up the Federal Reserve to stabilize money markets in 1913 but, as people hoarded their money in 1930, it didn’t act decisively enough to save the banks. They lowered rates at first, through 1930, but there was no sustained Quantitative Easing as seen from 2009-2014, to put cash into the banking system by buying up bonds and other assets. In 1927, the governor of the Federal Reserve’s New York branch, Benjamin Strong, promoted exactly such low interest rates in an effort to help Britain and France pay off their war debts to the U.S., helping to fuel the rising stock market by giving Wall Street what the French called un petit coup de whisky or “shot of whiskey.” Low interest rates meant more cash in circulation to invest in stocks. But Strong died in 1928 from complications of tuberculosis and morphine addiction and the Fed reversed its loose monetary policy. That, in turn, raised rates on variable-rate on-margin stock loans, helping to trigger the market collapse (fixed-rate loans stay the same after you borrow regardless of future fluctuations).

The Fed raised interest rates to 6% to cool the booming stock market by tightening credit and making bonds more attractive. In 1930, they lowered rates after the crash, as you’d expect. But, in 1931, they abandoned their previous policy of price stability in favor of stricter adherence to the gold standard, resulting in a 30% cash contraction by 1932. That was, no doubt, the wrong move. But their tight-money policy was in step with other central banks in Britain and Europe that feared inflation and tied currencies to gold bullion (not coins, because bars are easier for governments and central banks to control). Britain reverted to its original pre-WWI gold-sterling (pound) standard, causing a gold shortage and a run on American gold. France, meanwhile, hoarded their gold and refused to sell. As Chancellor of the Exchequer, equivalent to America’s Federal Reserve Chair, Winston Churchill re-tied the British pound to gold at the pre-war fix, which proved disastrous. The pound became overvalued, meaning that they couldn’t export coal, leading to unemployment and strikes. When critics said he was the worst chancellor ever, Churchill replied that he was “inclined to agree.” Economist Sebastian Mallaby wrote that “because exchange rates and therefore interest rates were yoked together under the gold standard, Europe’s central banks mimicked the Fed’s tight policy. Fettered to gold and each other, the world’s leading economies staggered into the Depression.” In a 2014 Atlantic magazine poll, one economist called the U.S. Fed’s post-crash monetary contraction the single worst decision in financial history. Inflation wasn’t going to be a threat, anyway, during a recession.

The Fed waffled during the downward spiral triggered by the recession, Stock Market Crash, and early bank failures. In 1930, they lowered interest rates from 6% to 2.5% but raised them again from 1.5% to 3.5% in 1931 to protect gold. They feared that foreign countries would swap dollars for gold, depleting the supply. The gold standard was a straightjacket, inhibiting growth, partly because they pegged gold to pre-WWI currency levels that were too low (the U.S. kept 40¢ of gold for every $1 in cash). The Fed protected banks at first with loose monetary policy but abandoned them in 1931-32 to protect gold and because of their irrational fear of inflation. Of America’s 25k banks in 1929, ~ 8k failed during the Great Depression, along with numerous businesses and farms. As we saw in Chapter 5, favoring Andrew Jackson’s vision over that of Alexander Hamilton, the U.S. used a decentralized banking system after 1833 that outlasted creation of the Federal Reserve in 1913. That exacerbated failures during the Great Depression as many small banks had most of their money loaned to local businesses or farms disrupted by, say, the Dust Bowl (more below); whereas bigger banks with local branches might’ve been able to weather the downturn. It’s counterfactual history, but no banks failed in 1930s Canada, where they’d followed Hamilton. Now, it was up to Congress and President Hoover to do what they could for banks with the Reconstruction Finance Corporation that we’ll discuss below. While the Federal Reserve’s tight monetary policy wasn’t the downturn’s sole cause, neither did it help alleviate it. Before the Fed, private financiers like J.P. Morgan provided liquidity on their own to stave off panics. After the crash, the Fed couldn’t do likewise because it was tied to the gold standard.

Ben Bernanke, Federal Reserve Chair from 2006-14, was a Depression historian and critic of the Fed’s policies from 1931-32, which is why he kept rates low and shored up banks after the downturn of 2008-09. It wasn’t just that there wasn’t enough cash during the Depression, but banks weren’t lending what they had, leading to what economist J.M. Keynes called a liquidity trap. Hard money advocates, on the other hand, charge that if governments hadn’t abandoned gold in the first place leading to inflation during WWI, there never would’ve been a correction after the return to gold in the late 1920s. While there’s still no consensus among economists on hard versus soft money, we can safely say that the U.S. and Britain indecisively switching on and off the gold standard backfired in the early 20th century.

Depression

Financial problems in markets and banking, combined with drops in consumer confidence, lead to contractions, or recessions. Recessions could be thought of as downward spirals. As workers lose confidence in the economy, they spend less, which causes other companies to lay off workers who, in turn, don’t spend either, and so on. The upside of capitalism is that the same process works in reverse, snowballing in a positive direction. In those cases, you won’t hear people comment that the economy is good, but at least the rate of hearing them complain about how bad it is declines some. Severe recessions are now called depressions though the U.S. luckily hasn’t dusted off that term since the 1930s, partly because of pro-active policies by Federal Reserve: injecting cash by buying up bank assets or, more drastically, wiping so much debt off banks’ books that they’re effectively “printing money.” President Hoover actually suggested the word depression because he thought it might soothe peoples’ nerves more than the traditional 19th-century term panic, as in the Panics of 1819, 1857, 1873, 1893 and 1907. It wasn’t much of an improvement on the killjoy meter, but the term stuck.

One upside to recessions is that there’s usually no inflation since prices are leveling off or even dropping. But wages stagnate, too, and bad downturns cause deflation, leading to a reverse price/wage spiral. In the 1930s, prices dropped around 25% but wages dropped 40%. From a borrower’s perspective, one downside of deflation is that the real value of debt rises as wages decline and the value of the dollar goes up (one dollar can “go further” and buy more groceries). The reverse upside of inflation is that debts effectively go down in relation to wages as the value of currency drops. For that reason, governments sometimes deliberately trigger inflation by printing money to lessen the impact of their own debts. But in a deflationary environment, consumers don’t spend because they’re always thinking that their money will be worth more later if they hang onto it. Why buy a car this month if it will be even cheaper next month? You can see why such fluctuations led the country to start the Federal Reserve in 1913 to stabilize currency as much as possible.

In the early 1930s, the downward effect of layoffs, hoarding, and lower spending spiraled worse than at any time in American history, the previous low being 1893. Eventually, ~25% of heads of households lost their jobs, with no unemployment insurance (in the chart above, the gray line is before a Bureau of Labor measured). Cleveland reported 50% unemployment. It was even worse, as you might expect, for minorities. African American heads-of-households experienced 50% unemployment. A staggering 44% of home mortgages foreclosed, as real estate values dropped 25%. Just to put some perspective on that, in the recent real estate-driven Great Recession of 2008-09, the foreclosure rate topped out at ¼ of that.

“Children in a democracy. A migratory family living in a trailer in an open field. No sanitation, no water. They come from Amarillo, Texas.” By Dorothea Lange, Bureau of Agricultural Economics, November 1940

With new Model A’s piling up in a scrap heap, Henry Ford hoped to spur the economy with the introduction of his one-piece, flat-head V-8 engine in 1932 — cheaper and bigger than previous eight-cylinder models sold by GM and used in planes and French cars. This early “hot rod” engine at least helped outlaws like Bonnie and Clyde escape the law. They could also steal cars as easily as horses because the new electric starters enabled enterprising thieves to bypass the ignition interlock and hot-wire the engine without a key. Gangster John Dillinger even sent Ford a thank you letter for the V-8 (police departments were behind the curve as tax revenues also fall during a recession). Alas, the iconic eight-banger wasn’t enough to rev the decelerating economy.

The U.S. experienced net emigration for the first time in its history in the 1930s. Unemployed workers started fires to get work on crews and committed crimes to be thrown in jail, where they could enjoy warmth and meals. Parolees asked to be put back in jail. Condom sales rose as birth rates fell. Divorce rates also fell because, like children, they’re expensive, but desertion rates by fathers rose.

Dust Bowl

Making matters worse, drought plagued the Great Plains from the Texas Panhandle to the Canadian provinces. The end of WWI in Europe diminished the wheat market as war-ravaged countries eventually rebounded and American rainfall decreased in the late 1920s. By 1929, the USSR was exporting wheat to Europe at pre-war levels. Wheat exports eventually went from $1/bushel to 25¢. When Europeans first settled the Great Plains in the late 19th century, developers spread the pseudo-scientific rumor that plowing brought rainfall by returning moisture from under the ground’s surface to the air. “Rain follow the plough!” was their slogan. Of course, that’s not the case. Then, internal combustion tractors meant farmers could cultivate more land, leaving the “wrong side up” insofar as it tilled the natural grasslands that held the soil together when buffalo roamed the Plains. In this case, the combination of better tractors, dropping wheat prices, and a worsening drought led to an unfortunate combination of technology and nature. Soil conservationist Hugh Hammond Bennett foresaw the problem but his warnings fell on deaf ears when wheat prices were high. Bennett led the Natural Resources Conservation Service after its precursor formed in 1932.

Making matters worse, drought plagued the Great Plains from the Texas Panhandle to the Canadian provinces. The end of WWI in Europe diminished the wheat market as war-ravaged countries eventually rebounded and American rainfall decreased in the late 1920s. By 1929, the USSR was exporting wheat to Europe at pre-war levels. Wheat exports eventually went from $1/bushel to 25¢. When Europeans first settled the Great Plains in the late 19th century, developers spread the pseudo-scientific rumor that plowing brought rainfall by returning moisture from under the ground’s surface to the air. “Rain follow the plough!” was their slogan. Of course, that’s not the case. Then, internal combustion tractors meant farmers could cultivate more land, leaving the “wrong side up” insofar as it tilled the natural grasslands that held the soil together when buffalo roamed the Plains. In this case, the combination of better tractors, dropping wheat prices, and a worsening drought led to an unfortunate combination of technology and nature. Soil conservationist Hugh Hammond Bennett foresaw the problem but his warnings fell on deaf ears when wheat prices were high. Bennett led the Natural Resources Conservation Service after its precursor formed in 1932.

Loose topsoil blew around in massive dirt storms during what became known as the Dust Bowl. You could tell a storm’s origin from the color of its soil (e.g. red was from Texas) and many coughed dust from their lungs for months. Livestock wandered off or suffocated when dirt filled their nostrils. One 1934 storm blew all the way across the Midwest and East before dropping its dirt in the Atlantic Ocean, alerting politicians to the problem’s severity. Static electricity in the storms killed vegetable gardens and jackrabbit and grasshopper plagues added to the misery. Plains historian Donald Worster wrote that the region went from “a spirited ‘home on the range where no discouraging words were heard,’ to a Santa Fe Chief [train] carrying bounteous heaps of grain to Chicago, and, finally, to an empty shack where the dust had drifted as high as the eaves.”

The Dust Bowl of 1930-36 destroyed thousands of uninsured farms in the Texas Panhandle and Oklahoma. In some fortunate cases, neighbors rallied for a penny auction when the bank sold off their foreclosed land. Armed neighbors bid low prices, intimidating anyone who bid the price up so that the original owner could buy back the farm cheap. But that didn’t help much as long as the drought continued. Plains Indians like the Kiowas and Comanches stayed on their allotments, grinding it out in even worse poverty than they were already used to, but many whites just left. Desperate Okies along with tenant farmers from Arkansas and southern Missouri loaded up their belongings and headed across the desert to the valleys of California to work as seasonal laborers in one of the biggest internal migrations in American history. Around one-third of farmers left the Dust Bowl-ravaged area. With such a labor surplus, exploitative California farm owners paid pitifully low wages and police eventually stopped the flow at the border, arresting migrants for vagrancy if they were entering the state with less than $50. For those that stayed behind there was a silver lining in these red, black, and brown clouds: their life expectancies rose over five years because they inadvertently struck the right balance between the under-nourishment of poor countries and over-eating of rich.

In most textbooks, the Okies (broadly defined) fade off-screen after the Depression, perhaps being mentioned briefly in relation to Bakersfield country musicians like Merle Haggard, Buck Owens or Dwight Yoakam. But they had a lasting demographic impact. For most of the second half of the 20th century, the population of Southern-born Los Angelinos exceeded the entire population of many Southern states. They voted Democrat during the Depression and New Deal of the 1930s (next chapter) and found work in munitions during World War II, including aviation. But their politics changed once they had money in their pockets. During the more prosperous post-war years, especially in Orange County then across the Sunbelt, they seeded a conservative revolution in American politics that launched the careers of Richard Nixon (R) and Ronald Reagan (R). The children of desperate 1930s migrants helped launch the Reagan Revolution that we’ll cover in Chapter 20.

Buy American Backfires

Leaders and economists struggled to find a solution. A natural impulse is to Buy American to save jobs. Portions of the Democrats’ 2009 stimulus contained such provisions and Donald Trump won the 2016 election on a quasi-protectionist platform, promising to scrap or rework trade agreements. Joe Biden supported Barack Obama’s foreign restrictions on federal purchases. In 1930, congressional Republicans enacted more extreme legislation, passing the highest protective tariffs since 1828, averaging across the board ~ a 60% import tax. Other business leaders and academics opposed the law and urged President Hoover to veto it. Henry Ford spent an evening at the White House trying to talk sense into Hoover. The House of Morgan’s representative claimed he got down on hands and knees and begged Hoover not to sign.

But sign he did and the Smoot-Hawley Tariff became law, despite Hoover’s reservations. Given that he called it “vicious, extortionist and obnoxious,” Hoover should have vetoed the bill because it only passed the Senate with 53 votes and 64 were then necessary to override a veto (67% of 96). The results were predictable and disastrous. Other countries passed their own retaliatory tariffs on American exports, triggering a trade war as world exchange plummeted over 66% the first year, deepening the depression in all countries. In fact, the League of Nations was trying to negotiate a tariff truce to stave off the worsening crisis just as Congress passed Smoot-Hawley. Elected politicians don’t always make great decisions and many economists consider Depression-era protectionism a colossal mistake. Smoot-Hawley not only hurt the global economy, it undercut international cooperation at a time when the world needed more constructive interaction among nations. There’s an old maxim: “When goods don’t cross frontiers, armies will.”

However, Nobel-winning economist Paul Krugman disagrees. He argues that world trade was declining at an even faster clip before Smoot-Hawley than after. Krugman points out that the steep decline began in 1929, not ’30 when the bill passed. Critics of Smoot-Hawley are confusing cause and effect, according to Krugman and other leading economists who argue that the tariff exacerbated but certainly didn’t cause the Great Depression. Krugman argues that, while protectionism reduces efficiency and will lead to a net loss, decline caused by a trade war should theoretically be mostly offset by increased opportunities for domestic growth — i.e. the upside of “buying American.”

Hoover & Congress Flounder

Contrary to popular belief, both then and now, President Herbert Hoover was not a laissez-faire Republican in the mold of his predecessors, Harding and Coolidge. In fact, conservative historians have latched onto his economic intervention to argue that Hoover caused, or at least worsened, the Depression since he increased federal spending, grew the deficit, and raised taxes. He pressured companies to keep wages high even as their profits plummeted, inadvertently pricing workers out of the labor force. As we just saw, he signed off on the tariff increase. But the solutions true conservatives at the time offered weren’t appealing either.

When the economy first tanked, Hoover’s Treasury Secretary, Andrew Mellon, told him to let things run their course — creative destruction in Marxist terminology — famously advising to “liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate…it will purge the rottenness out of the system.” Mellon thought the downturn would shake some inefficiency out of the system and toughen up Americans. A significant recession in 1921 had turned around quickly on its own, after all. Mellon said, “Enterprising people will pick up the wrecks from less competent people.”

But letting the entire system collapse and wiping out most Americans didn’t sit right with Hoover. Indeed, it’s surprising someone like Mellon would like capitalism so much if he thought purging things so dramatically from time to time was how it should work. Imagine nearly every American going bankrupt and having to start over once or twice per lifetime, leading to widespread upheaval, destruction of retirement savings, and long waiting lists to check out Marx’s Communist Manifesto from the local library. Thus Hoover, being less of a purist than Mellon, met constantly with bankers, economists, and state politicians trying to find a solution. He encouraged local and state governments to initiate infrastructure projects. He wanted to create jobs on a large scale, but Congress rejected his ideas to build an interstate highway system and to broaden and dredge the St. Lawrence River to connect the Atlantic Ocean and Great Lakes for oceangoing ships (replacing the smaller, outdated Erie Canal). The 71st and 72nd Congresses were factious in the Depression’s early years, offering little in the way of solutions to the public or President Hoover. Dwight Eisenhower got both the interstate and St. Lawrence River measures approved in the 1950s — the former constituting the largest federal project in American history — but that was too late to help Hoover or people in the early 1930s. Had Congress cooperated with Hoover, he could’ve started those projects earlier and perhaps jump-started the economy. But President Hoover was laissez-faire himself when it came to welfare. He steadfastly refused direct federal relief to those suffering, arguing that it was un-American and that they were too proud to take it anyway (or, if not, should be).

Hoover wavered on taxes, first lowering them to stimulate spending and then raising them on the wealthy in 1932 to balance the budget, from 25% to 63%. Neither worked. He and Congress set up an unprecedented organization, the Reconstruction Finance Corporation (RFC) to bail out the banking industry through government loans and investments and create public works projects to spur employment by investing in utilities and infrastructure, including railroads. It also borrowed money that wasn’t being put to use from good banks. The RFC worked well eventually, bolstering FDR’s New Deal and helping to win World War II before being disbanded in 1957, but it didn’t help Hoover much toward the end of his first term. The RFC oversaw neither of two big public projects in the early 1930s. Boulder Dam (now Hoover Dam) was the biggest, but the Bureau of Reclamation contracted to have it built before the Depression. San Francisco’s Golden Gate Bridge was a state project financed by Bank of America in 1930 after its original municipal bond offering failed to attract other investors. Still, the public-private Hoover Dam project provided both power and inspiration during the depths of the Great Depression. It employed thousands while growing Las Vegas, powering much of Nevada, Arizona, and southern California, and presenting a site that was the most impressive, cutting-edge, man-made structure Americans had seen as of the 1930s.

The RFC worked well as far as it went. For a while, the overall rate of bank failure fell from 70 to 1 per week and it saved one major Chicago bank, Central Republic. However, it wasn’t enough to turn around the overall economy and it didn’t start until early 1932, late in Hoover’s presidency. Bank failures were on the rise again by the time he left office. Still, the idea of government investing in, rather than simply bailing out, companies had a lasting impact. The TARP bank “bailouts” and General Motors’ bankruptcy re-organization of 2008-09 operated on that same principle, though much of the public misinterpreted both as simple bailouts. In both cases, the government earned its money back. In some ways, Hoover was less like his Republican predecessors Harding and Coolidge than he was his successor, Democrat Franklin Roosevelt, except that Hoover’s stimulus packages never got off the ground because of an obstinate Congress and the RFC was “too little, too late.”

As a private citizen, Hoover was a legendary humanitarian in his day, feeding millions in Europe after WWI from his own pocket and leading government-sanctioned relief efforts (e.g. Belgian Relief). The first president born west of the Mississippi, he was adopted by Iowa Quakers as an orphan, studied engineering at Stanford (in its first class), and was a successful mining engineer in Australia and China. Having survived the Boxer Rebellion in China (Chapter 3) to lead post-WWI relief efforts, Commerce Secretary Hoover helped fuel the prosperous 1920s through standardization in fields like communication and transportation. But the RFC was a top-down solution and since President Hoover mostly resisted direct relief in the Depression, the public naturally turned on him, blaming him for not doing enough as they grew hungrier and angrier. Hoover callously said, “no one is starving.” Some were, though. A few thousand even starved to death, and millions more went hungry and suffered from malnutrition. Unemployed people built ramshackle shantytowns out of wood scraps and paper they derisively named Hoovervilles. Symbolically, a fire gutted the West Wing of the White House on Christmas Eve, 1929. Finally, Hoover signed the Emergency Relief & Construction Act in 1932 but that mainly just funneled money from the RFC to the states to create jobs. He hoped the Red Cross would do more to provide food.

Bonus Army March

The most famous Hoovervilles were in Washington, D.C. In the Bonus Army March, WWI veterans came to the capital demanding early payment of bonuses due 13 years later, in 1945 (see video below). There were ~ 17k vets but, with their families, the group numbered ~ 43k. They camped out on the Mall and in Anacostia Flats across the Potomac River while Congress debated the matter. The House of Representatives passed a resolution authorizing the payments but the Senate blocked it, explaining that the government didn’t have a $2 billion surplus on hand (~$38 billion today). Hoover ordered them evicted, which the police and Army did (see photo at the top of the chapter). Led by Douglas MacArthur, young soldiers with bayonets affixed burned and trampled encampments and turned fire-hoses and tear gas on their older veteran counterparts. MacArthur’s aide, future two-term president Dwight Eisenhower, tried to talk him out of it, saying “I told that dumb [S.O.B.] not to go down there” and President Hoover wasn’t happy either. A decade later, “Mac” [MacArthur] and “Ike” [Eisenhower] led WWII Army troops in the Pacific and Europe, respectively.

Can you imagine a scenario like the Bonus March and response today, with the military attacking and burning down the camps of veterans? That would no doubt light up cable TV and social media. The veterans eventually got their bonuses in 1936 when Congress passed an early payment over Franklin Roosevelt’s veto. In 1932, though, that same Franklin Roosevelt benefited from the fiasco, when he was the Democratic candidate running against Hoover that fall. When the Army went into the camps, Roosevelt told an aide, “I’ve just won the election.” He later hired veterans, including those involved in the Bonus March, for forest work in the Civilian Conservation Corps, a centerpiece of his New Deal (next chapter).

Similar violence ensued in Detroit, where Henry Ford’s troops broke up a strike at the Model A plant, killing four line workers and injuring 54. Ford had initially tried to do his bit, raising wages and lowering car prices, but the market dried up and he’d laid off 66% of his workers. Not entirely without merit, President Hoover saw the auto union as a communist front and sent in the 12th Infantry Division and 3rd Cavalry Regiment to backup Dearborn’s police. At the funeral, fellow employees sang the communist anthem Internationale. This happened in the United States. These events, along with the food lines and hobos, indicate that the country was in the midst of its deepest crisis since the Civil War.

Bonus Army Shacks on the Anacostia Flats, Washington, D.C., Burning After the Battle with the Military (Capitol in the Background), 1932, National Archives

Conclusion

By the end of his term, Hoover was at a loss, despite being the first president in history to try and take action to alleviate a recession. Perhaps he was waiting for another Hoover to come along, the way he had after the Great War. However, charities and the private sector produced no such white knights and the problem’s scale far outstripped the resources of charities. With people going hungry and Ford workers singing “Internationale,” capitalism seemed on the brink, as close as it’s come to being fundamentally questioned in American history. One primary problem, it seemed, was the connection of cyclical markets and investment banks to commercial banks, where regular people kept their money instead of stashing it under the mattress where it could be stolen, burned, or eaten away more gradually by inflation. For some unlucky Americans, it was just as good as stolen or burned after they’d entrusted it to banks connected to the broader market.

Banking failures were at the heart of America’s worst depression, but it had multiple underlying causes: a recession (caused by income inequality, market saturation, and installment buying), weak agriculture (caused by drought and over-investment), the Stock Market Crash (fueled by on margin investing), and trade protectionism (Smoot-Hawley) all contributed to the perfect storm. The Fed’s unwillingness to inject cash into the system in 1931-32 exacerbated the problem, as they were, instead, restricting cash to return to the gold standard.

Similar problems were happening in other countries, especially Germany but also Brazil, Poland, Canada, Argentina, and across Southeast Asia. In May 1931, a run on a major Austrian bank, the Creditanstalt, triggered panic across Europe and in Britain. While some historians cite the Market Crash as a symptom rather than a cause of the Great Depression, it’s important to realize the connection between the stock market and banking and corporate spending. The unemployment graph below underscores the Market Crash’s importance to the Depression’s timing.

Andrew Mellon’s idea of just letting things run their course wasn’t going to cut it, regardless of its actual merit; however, we don’t have proof that the economy wouldn’t have turned around just as quickly by doing nothing. In a democracy, voters would never stand for doing nothing even if that really would solve things faster than tinkering. Hoover tried some solutions, but it’s unclear whether they helped some or just complicated things and, in any event, Congress blocked his major stimulus packages. By 1932, many people were in desperate straits and demanding a dramatic change in government strategy, starting with some food.

Optional Viewing & Reading:

Explore the Dust Bowl (NEH)

Dorothea Lange Photo Gallery (Oakland Museum of California)

Olivia Waxman, “What Caused the Stock Market Crash of 1929 — And What We Still Get Wrong About It” (TIME, 10.24.19)

B. Lynn Ingram, “The West Without Water: What Can Past Droughts Tell Us About Tomorrow?” (Origins)

Susan Borowski, “The Dust Bowl: A Wakeup Call” (AAAS, 12.3.12)

Sandra Garcia, “She Survived A Slave Ship, the Civil War & Great Depression. Her Name Was Redoshi” (NYT, 4.3.19)

Todd Tucker, “What Donald Trump Could Learn From Herbert Hoover” (Politico, 4.26.20)

Jennifer Keene, Et Al., “The Sad Tale of the Bonus Marchers” (The Doughboy Center)